MKT Cap: 175 B

Price action YTD: Up 30%

*Not financial advice

Overview of AMEX:

-Products

American Express Company (Amex) had a 4.61% worldwide market share by payment volume in 2022. Based on purchase volume, the company has a 13% market share and is the fourth-largest card network globally. The company is an American bank holding company and multinational financial services corporation specializing in payment cards. Amex is known for credit cards, processing payments, and providing travel services. As of 2023, 141.2 million cards were in circulation with an average spend of $24,059. The company operates branchless banks. Branchless banks offer services via the Internet, mobile app, email, and other electronic means, often including telephone, online chat, and mobile check deposit.

Breakdown of the products

The company’s identity:

-Brand values

- Involvement with consumers

Amex is known for having the best cards around the world. To get a card a customer must have a good credit history and a high credit rating. This selectiveness has allowed the brand to create an identity associated with success, financial freedom, and luxury.

Consumers get special offers on a wide range of flights, hotels, and car rentals

Front-of-the-line presale tickets and access to special events before the general public

Special offers on shopping, dining, and travel

Earn points on purchases

Users can borrow money

Get insurance through Amex

→Overall, Amex provides a specialized experience for customers with its unique offerings.

Geographics:

The company operates as an integrated payments company in the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, and the Caribbean. The five largest international countries Amex operates in are the UK, Japan, Australia, Canada, and Mexico.

Brand Partners and Memberships:

The partnerships and memberships that the company provides have created a moat. When customers use other cards they cannot obtain the same exclusivity that Amex offers.

Management:

-Experience

-Share buybacks

-Stock-based compensation

American Express CEO is the perfect example of who you want running a company. Mr. Squeri has been Chairman and CEO of American Express Company since 2018. He has held many positions during his 38 years at American Express, including Vice Chairman of American Express Company, Group President of Global Corporate Services, Group President of Global Services, and served as the Executive Vice President and Chief Information Officer.

-He directly owns 0.027% of the company's shares, worth €43.42M. (Incentive)

CIO, Ravi Radhakrishnan joined American Express in 2022 from Wells Fargo, where he served as CIO for Commercial Banking and Corporate & Investment Banking, as well as interim Chief Information Security Officer for the firm.

Year to date Amex has bought back over a billion dollars of shares. Buybacks increase the value of the remaining shares and show management's ability to allocate capital properly. The timing and amount of common shares purchased under the company’s authorized capital plans will depend on various factors, including the company’s business plans, financial performance and market conditions. However, the company is committed to buying back shares if the environment is right.

Stock-based compensation (SBC) as a % of revenue remains low indicating management's ability to allocate capital properly. SBC dilutes the ownership of existing shareholders by increasing the number of shares outstanding.

Advertising:

-Increase marketing expense

In Q2 2024, American Express CEO Stephen Squeri stated that the company will spend 6 billion dollars on marketing. This investment will lead to increased brand awareness, more customers, and a better retention rate.

Upside:

Strategic outlook

The 2024 growth strategy, termed the Power of Three growth plan, aims to significantly expand the company's operations with goals related to product innovation, enhancing customer experiences, and expanding into new markets, effectively cultivating a competitive moat. This plan outlines an ambitious trajectory to double the company's business, with strategic investments targeting areas including e-commerce and international revenue.

Growing receivables:

Worldwide Total Ending Loans and Card Member Receivables are growing, which indicates increased lending and spending activity by customers, reflecting higher demand for credit and potentially improved economic conditions. This suggests strong consumer confidence and spending which should translate into increased revenue and profitability.

Downside:

Many merchants accept American Express, but its acceptance is generally less widespread compared to Visa and MasterCard. This is due to historically higher merchant fees charged by American Express, which has led smaller businesses and retailers to prefer other payment networks. But Amex has mentioned it wants to target small business owners. This indicates the company's awareness and understanding that there is still room for growth and improvement.

Plus CEO Steven Squeri attributes says Amex is now accepted at 99% of all places that accept credit cards.

A quick review of how this company is doing:

American Express Co has grown revenue at 13.83% over the past year, which is strong growth. The company also has a free cash flow margin of 33.86%, which suggests the company is very profitable.

Financials:

Cash flow→

Buyback Activity:

In the most recent financial quarter, American Express authorized the repurchase of a significant number of shares. Approximately 7 million shares were repurchased during the second quarter of 2024, reflecting the company's commitment to returning capital. This amounted to 1.7 billion dollars being allocated in the interest of shareholders.

Net income growth:

2022-2024 (TTM)

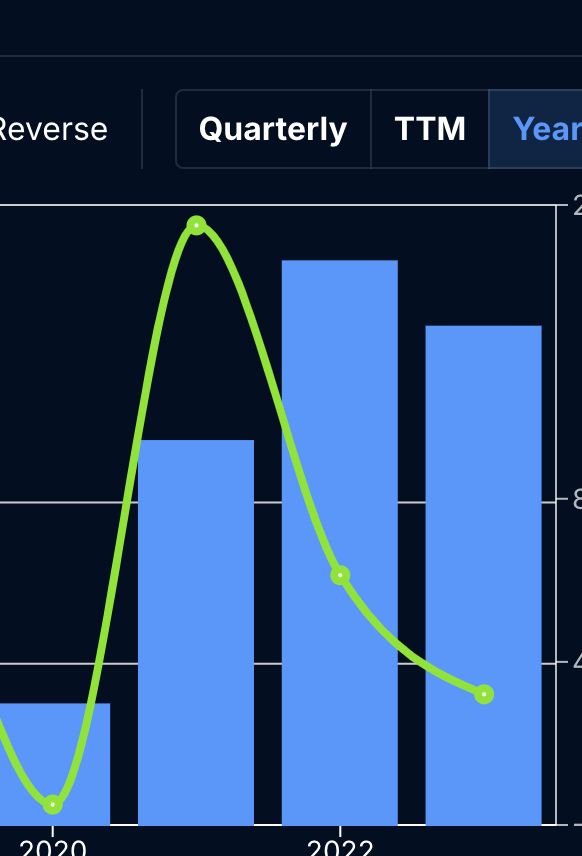

Share buybacks

2020-2024

Free cash flow

2020-2023 (free cash has been growing but momentum was lost in 2023)

Income statement→

EBITDA Growth

(Growth in 2020-2023)

EPS Growth

2020-2023

Balance Sheet→

More assets than liabilities

52B of cash and cash equivalents compared to 51B of long-term debt ✅

Increased shareholders equity

An increase in shareholders' equity indicates that the company is generating more value for its shareholders,

Metrics→

Margins have decreased over the last couple of years

Current Ratio of 0.73. A current ratio of 0.73 means that the company has $0.73 in current assets for every $1.00 of current liabilities, indicating potential liquidity challenges

8 debt-to-equity ratio, meaning the company has $8 in debt for every $1 of shareholders' equity, indicating a highly leveraged capital structure.

DCF:

My fair value with a 10% margin of safety = $190

My thoughts:

American Express (NYSE: AXP) has demonstrated superior financial performance, with a 50% revenue increase since 2021 and a robust Q2 2024 net income of $3.0 billion, or $4.15 per share. Despite this growth, the company's high debt-to-equity ratio of 8 signals a highly leveraged capital structure, which is atypical for financial institutions and may pose risks. However, the company has operated with a high level of leverage for decades. This is due to its business model, which involves a substantial amount of lending.

It is important to note that the core of the Amex strategy is to attract younger cardmembers without compromising credit quality. The benefits of this are clear: more customers paying annual card fees, and more spending on the platform

Strategically, American Express is focused on expanding U.S. acceptance, accelerating international coverage through partnerships, and investing heavily in marketing, with a $6 billion spend aimed at growing its customer base. The company also aims to double its business by targeting e-commerce and international markets, though it faces challenges with merchant acceptance compared to competitors like Visa and MasterCard.

While margins have decreased, and free cash flow momentum slowed in 2023, American Express continues to demonstrate shareholder commitment through significant share repurchases. The company's moat, built on exclusive partnerships and memberships, remains strong, offering a unique value proposition to customers.

In conclusion, while American Express shows potential for growth, particularly in untapped markets, its high leverage and margin compression warrant careful consideration. The company's ability to execute its strategic plans and navigate financial risks will be key to sustaining long-term shareholder value.

Fair Value = $190 *Not financial advice